[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i) of dated the 26thSeptember, 2012]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification No. 85/2012 - Customs (N.T.)

New Delhi, the 26th September, 2012

G.S.R…..(E).- In exercise of the powers conferred by sub-section (1) of section 4 of the Customs Act, 1962 (52 of 1962) and in supersession of notification of the Government of India in the Ministry of Finance, Department of Revenue No.16/2002-Customs (N.T.) dated the 7th March, 2002, published in the Gazette of India, Extraordinary vide number G.S.R. 172(E), dated the 7th March, 2002, the Central Board of Excise and Customs appoints the officers mentioned in column (2) of the Table I and Table II given below who shall have the jurisdiction in relation to an order or decision of the officer, subordinate to that officer, mentioned in column (3) of the Table I and Table II, respectively, for the purposes of the Customs Act, 1962 and the provisions made thereunder-

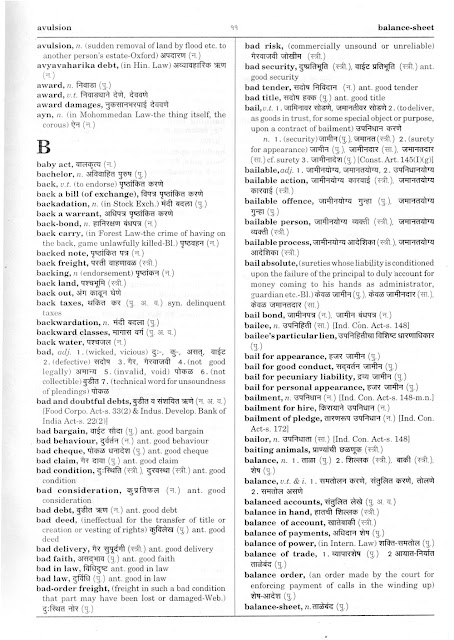

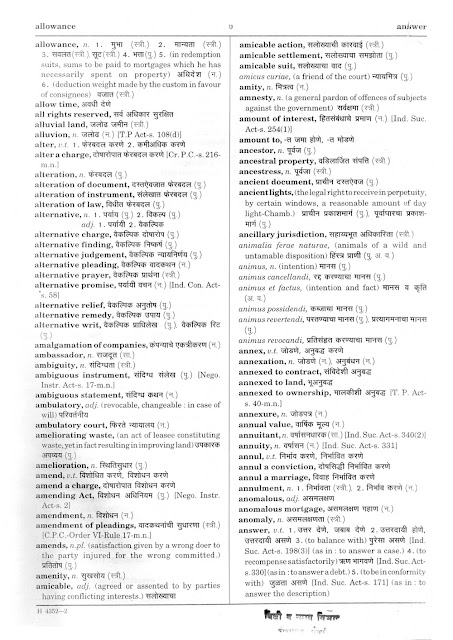

Table I

| S.No . | Designation of officer | Jurisdiction |

| (1) | (2) | (3) |

| 1. | Chief Commissioner of Customs, Ahmedabad | ( i ) Commissioners of Customs (Appeals), Ahmedabad – I (ii) Commissioners of Customs (Appeals), Kandla (iii) Commissioners of Customs (Appeals), Jamnagar |

| 2. | Chief Commissioner of Customs, Bangalore | Commissioners of Customs (Appeals), Bangalore |

| 3. | Chief Commissioner of Customs, Chennai | Commissioners of Customs (Appeals), Chennai |

| 4. | Chief Commissioner of Customs, Delhi | ( i ) Commissioners of Customs (Appeals), Delhi-I (ii) Commissioners of Customs (Appeals), Delhi-II |

| 5. | Chief Commissioner of Customs, Kolkata | Commissioners of Customs (Appeals), Kolkata |

| 6. | Chief Commissioner of Customs, Mumbai-I | Commissioners of Customs (Appeals), Mumbai - I |

| 7. | Chief Commissioner of Customs, Mumbai-II | Commissioners of Customs (Appeals), Mumbai –II |

| 8. | Chief Commissioner of Customs, Mumbai III | Commissioners of Customs (Appeals), Mumbai III |

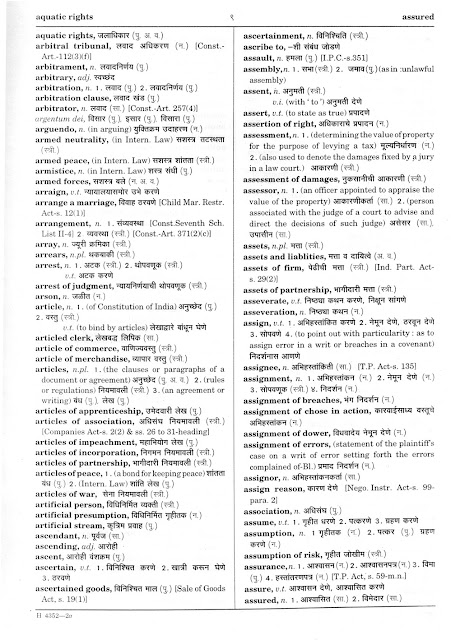

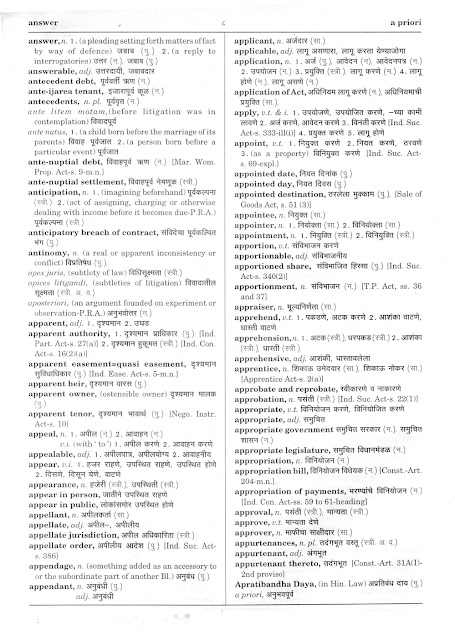

Table II

| Sl . No. | Designation of officer | Jurisdiction |

| (1) | (2) | (3) |

| 1. | Commissioner of Customs (Appeals), Ahmedabad | Commissioners of Customs, Ahmedabad, Kandla, Commissioner of Customs (Preventive) Jamnagar. |

| 2. | Commissioner of Customs (Appeals), Kandla | Commissioners of Customs, Ahmedabad, Kandla, Commissioner of Customs (Preventive) Jamnagar. |

| 3. | Commissioner of Customs (Appeals), Jamnagar | Commissioners of Customs, Ahmedabad, Kandla, Commissioner of Customs (Preventive) Jamnagar. |

| 4. | Commissioner of Customs (Appeals), Bangalore | Commissioners of Customs, Bangalore, Mangalore. |

| 5. | Commissioner of Customs (Appeals), Chennai | Commissioners of Customs, Port (Import) Chennai, Port (Export) Chennai, Airport and Aircargo Chennai, (Preventive) Chennai. |

| 6. | Commissioner of Customs (Appeals),Delhi-I | Commissioners of Customs, Aircargo (Import and General) Delhi, Aircargo (Export) Delhi, Commissioners of Customs, (ICDs) Delhi, (Preventive), Delhi. |

| 7. | Commissioner of Customs (Appeals), Delhi -II | Commissioners of Customs, Aircargo (Import and General) Delhi, Aircargo (Export) Delhi, Commissioners of Customs, (ICDs) Delhi, (Preventive), Delhi. |

| 8. | Commissioner of Customs (Appeals), Kolkata | Commissioners of Customs, (Port) Kolkata, (Airport) Kolkata, (Preventive) West-Bengal. |

| 9. | Commissioner of Customs (Appeals),Mumbai-I | Commissioners of Customs (General), Mumbai, (Import) Mumbai, (Export) Mumbai, |

| 10. | Commissioner of Customs (Appeals), Mumbai-II | Commissioners of Customs, (Import) Nhava Sheva and Container Freight Station Mulund, (Export) Nhava Sheva. |

| 11. | Commissioner of Customs (Appeals), Mumbai-III | Commissioners of Customs, (Airport) Mumbai, Aircargo (Export) Mumbai, Aircargo (Import) Mumbai, (Preventive) Mumbai: |

Provided that a Chief Commissioner of Customs, within his jurisdiction, specify, the jurisdiction of a Commissioner of Customs (Appeals) and jurisdiction of such Commissioner of Customs (Appeals) shall be limited to the jurisdiction so specified.”

[F.No. 450/88/2012-Cus.IV]

(M.V. Vasudevan)

Under Secretary to the Government of India